Financial Confidence Starts Here

Real strategies for Australians who want to take control of their money. Our autumn 2025 intake brings together practical planning skills with personal support from people who've helped hundreds navigate everything from buying first homes to managing retirement.

Reserve Your Spot

What You'll Actually Learn

We skip the textbook theory. These are the planning tools you'll use right away—whether you're sorting out your first budget or figuring out how to fund a career change at 45.

Foundation Phase

Getting your financial house in order sounds boring. But once you see where your money actually goes, it changes everything.

- Cash flow mapping that works in real life

- Debt reduction without living on rice and beans

- Building emergency funds that you won't raid

- Australian tax basics for regular people

Growth Phase

Once you've got breathing room, we look at building something. No get-rich-quick schemes—just strategies that match your actual situation.

- Investment options explained without jargon

- Property decisions beyond the hype

- Super strategies that make sense

- Risk management you can afford

Advanced Planning

Life gets complicated. We help you think through the big decisions before they become urgent.

- Career transitions and income changes

- Family planning financial realities

- Business ownership considerations

- Retirement planning that's actually achievable

Who's Teaching This Stuff

These aren't distant financial gurus. They're local professionals who work with NSW families every week. And yes, they remember what it's like to feel overwhelmed by money decisions.

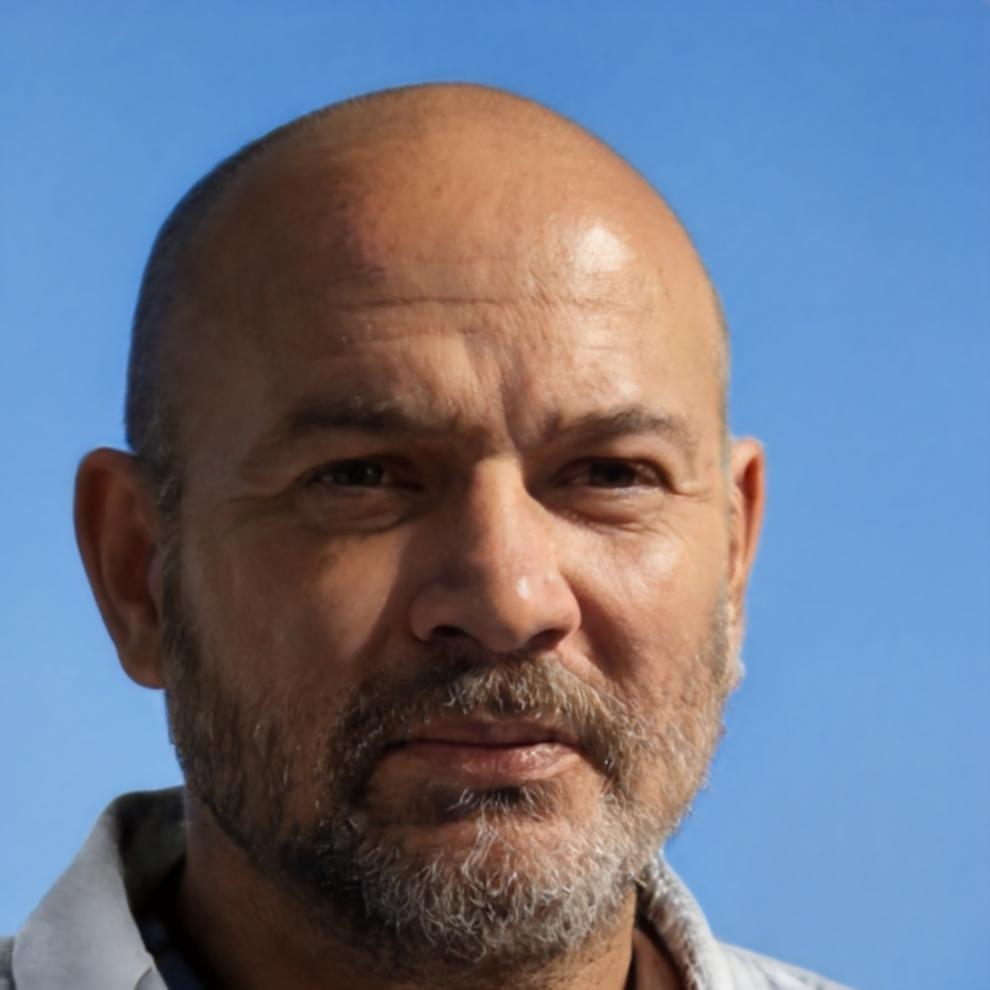

Fletcher Kavanagh

Spent 14 years helping families recover from financial setbacks. Now teaches the prevention side of things.

Siobhan Fenwick

Makes investment concepts click for people who thought shares were "too risky" or "too complicated."

Dimitri Huxley

Tax advisor who actually enjoys explaining why your return looks the way it does. Rare breed.

Astrid Pemberton

Specializes in helping people figure out what retirement might actually look like—and cost.

Classes Start March 2025

Tuesday evenings, 6:30-8:30pm at our Stockland Glendale location. Twelve weeks that might change how you think about money for good. We cap groups at 16 people because discussion matters more than lectures.